Offshore Company Formation : A Comprehensive Guide for Entrepreneurs

Offshore Company Formation : A Comprehensive Guide for Entrepreneurs

Blog Article

Approaches for Cost-Effective Offshore Firm Formation

When considering offshore business formation, the pursuit for cost-effectiveness ends up being a vital worry for businesses seeking to broaden their procedures globally. In a landscape where financial prudence rules supreme, the strategies used in structuring offshore entities can make all the difference in accomplishing economic efficiency and functional success. From browsing the complexities of territory choice to executing tax-efficient frameworks, the journey towards establishing an overseas visibility is swarming with possibilities and difficulties. By checking out nuanced strategies that mix legal conformity, monetary optimization, and technical advancements, organizations can start a course in the direction of overseas business development that is both economically prudent and tactically sound.

Picking the Right Territory

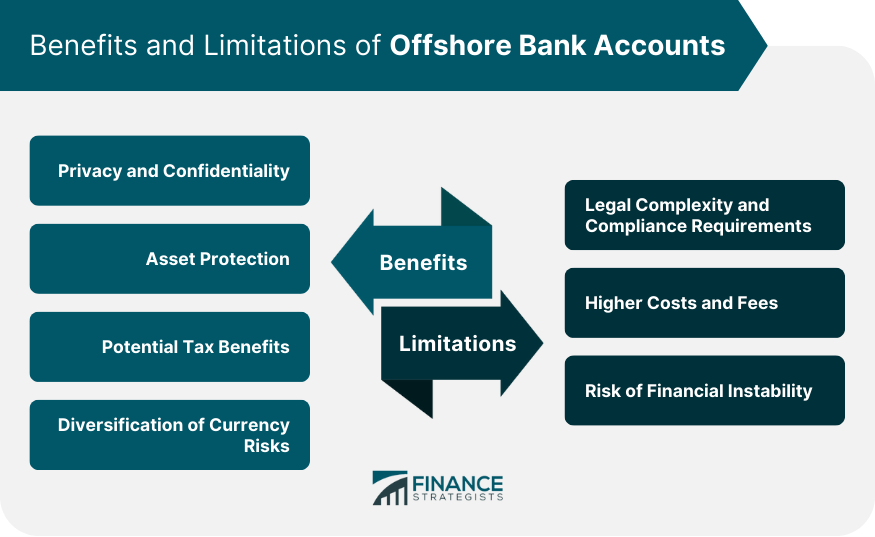

When establishing an offshore company, picking the ideal territory is a vital decision that can significantly impact the success and cost-effectiveness of the formation process. The territory selected will certainly determine the regulative framework within which the firm operates, impacting taxation, reporting demands, privacy legislations, and overall service adaptability.

When selecting a jurisdiction for your overseas business, numerous variables must be considered to ensure the choice lines up with your calculated objectives. One essential aspect is the tax obligation regimen of the jurisdiction, as it can have a substantial effect on the business's productivity. In addition, the level of regulatory conformity required, the political and economic stability of the jurisdiction, and the convenience of doing service must all be examined.

In addition, the online reputation of the jurisdiction in the global business area is essential, as it can affect the assumption of your company by customers, companions, and financial institutions - offshore company formation. By thoroughly analyzing these aspects and looking for professional suggestions, you can pick the right jurisdiction for your offshore company that optimizes cost-effectiveness and sustains your service objectives

Structuring Your Business Effectively

To make certain optimum performance in structuring your offshore company, precise interest has to be given to the organizational framework. By developing a transparent possession framework, you can ensure smooth decision-making procedures and clear lines of authority within the firm.

Following, it is crucial to take into consideration the tax obligation ramifications of the selected framework. Various territories provide varying tax obligation advantages and motivations for overseas companies. By thoroughly examining the tax obligation laws and guidelines of the selected territory, you can enhance your firm's tax efficiency and minimize unnecessary costs.

In addition, keeping correct paperwork and records is critical for the efficient structuring of your overseas business. By maintaining updated and exact documents of monetary purchases, company choices, and compliance documents, you can guarantee openness and liability within the company. This not only facilitates smooth procedures however additionally assists in demonstrating compliance with regulative needs.

Leveraging Innovation for Savings

Effective structuring of your offshore business not only pivots on thorough interest to business structures however also on leveraging innovation for savings. In today's electronic age, innovation plays a pivotal duty in enhancing processes, minimizing costs, and raising efficiency. One method to leverage technology for financial savings in overseas business development read the full info here is by utilizing cloud-based solutions for data storage and collaboration. Cloud technology eliminates the requirement for costly physical facilities, decreases maintenance expenses, and provides flexibility for remote job. Furthermore, automation devices such as electronic trademark systems, accounting software program, and project administration systems can considerably lower manual work costs and boost overall efficiency. Accepting on the internet communication tools like video conferencing and messaging applications can additionally result in set you back savings by minimizing the need for traveling expenditures. By integrating innovation tactically right into your offshore company development process, you can achieve considerable financial savings while boosting operational efficiency.

Minimizing Tax Liabilities

Utilizing tactical tax obligation preparation methods can successfully reduce the economic worry of tax obligation liabilities for overseas business. Among the most usual techniques for reducing tax responsibilities is through profit shifting. By dispersing profits to entities in low-tax jurisdictions, overseas business can legally reduce their overall tax obligation commitments. Furthermore, making the most of tax incentives and exceptions provided by the territory where the overseas business is signed up can lead to significant view publisher site financial savings.

An additional strategy to minimizing tax obligation liabilities is by structuring the overseas firm in a tax-efficient fashion - offshore company formation. This includes thoroughly making the ownership and operational framework to optimize tax advantages. For example, establishing a holding check my blog firm in a jurisdiction with desirable tax regulations can help decrease and combine earnings tax obligation exposure.

Additionally, remaining upgraded on global tax laws and conformity requirements is critical for decreasing tax obligations. By ensuring strict adherence to tax regulations and regulations, offshore companies can prevent pricey fines and tax obligation disputes. Looking for specialist suggestions from tax obligation professionals or legal professionals concentrated on global tax obligation issues can additionally provide valuable insights right into efficient tax planning techniques.

Making Sure Conformity and Danger Reduction

Implementing durable conformity measures is essential for overseas companies to alleviate threats and keep regulatory adherence. To make sure compliance and reduce dangers, offshore firms need to conduct complete due diligence on clients and company companions to avoid participation in immoral activities.

In addition, staying abreast of altering laws and legal demands is vital for offshore business to adjust their compliance methods accordingly. Engaging legal experts or conformity professionals can offer useful advice on browsing complex regulative landscapes and making certain adherence to global standards. By focusing on conformity and threat reduction, offshore companies can boost openness, develop trust with stakeholders, and guard their procedures from prospective legal consequences.

Final Thought

Making use of tactical tax planning methods can properly decrease the monetary problem of tax obligation responsibilities for overseas companies. By distributing revenues to entities in low-tax jurisdictions, offshore business can legally lower their overall tax obligations. Additionally, taking advantage of tax incentives and exemptions used by the territory where the offshore company is signed up can result in considerable cost savings.

By making sure stringent adherence to tax obligation legislations and laws, overseas firms can avoid expensive penalties and tax disputes.In verdict, affordable overseas business formation calls for mindful consideration of jurisdiction, reliable structuring, modern technology use, tax obligation reduction, and conformity.

Report this page